TurboTax Login - Log in to Your TurboTax Account

Logging into TurboTax is an essential step to access your account and manage your tax filings. TurboTax is a popular software package for tax preparation, designed to simplify the process of filing taxes for individuals and businesses. Here's a comprehensive guide on TurboTax login and its features:

Step-by-Step Guide to TurboTax Login

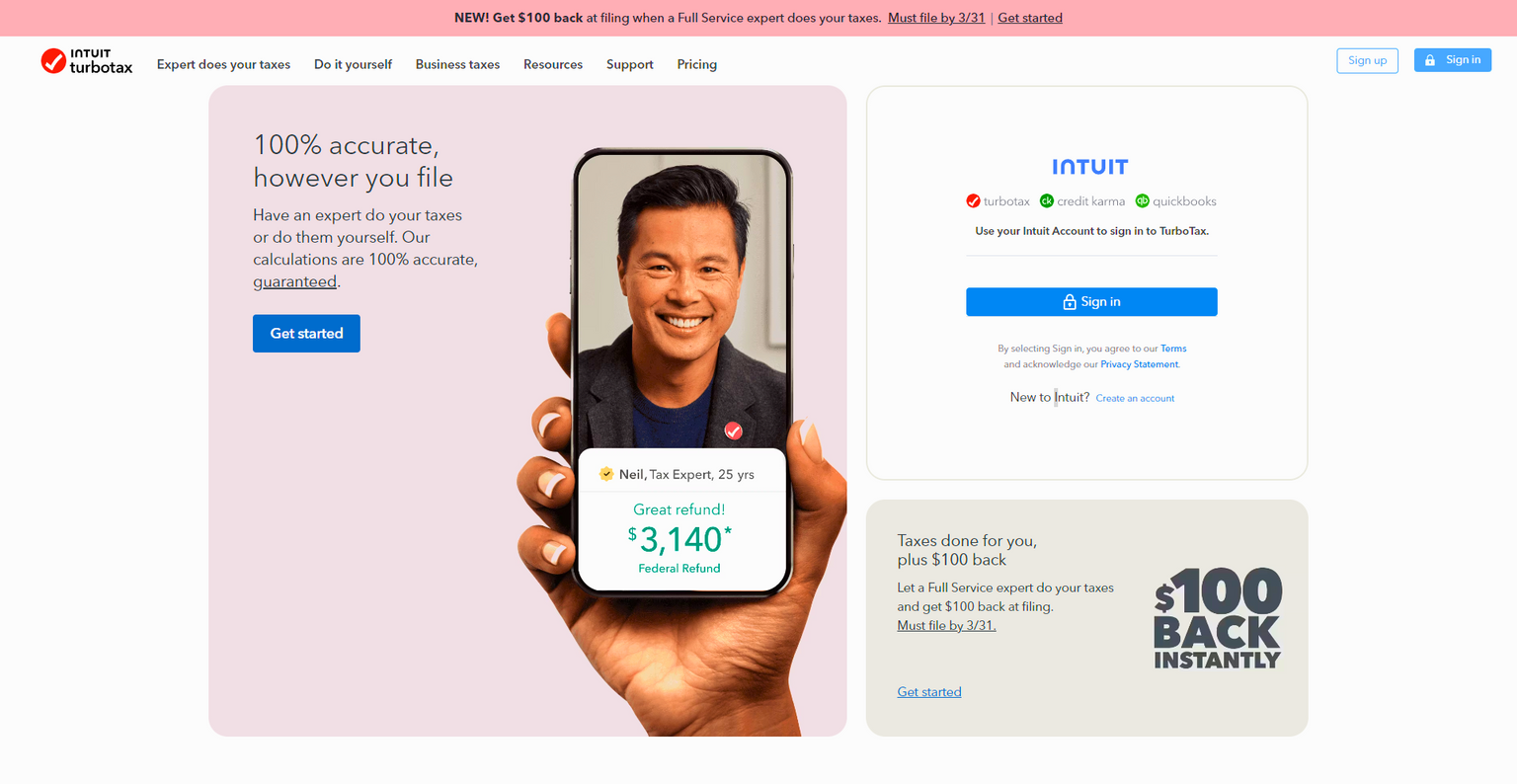

- Visit the Official TurboTax Website: Open your web browser and navigate to the official TurboTax website by typing TurboTax Login on your browser.

- Click on 'Sign In': On the top-right corner of the homepage, you'll find the 'TubroTax Login' button. Click on it to proceed.

- Enter Your Credentials: In the login page, enter your TurboTax username and password. If you're a new user, you can create an account by clicking on 'Create an account.'

- Two-Factor Authentication: For added security, TurboTax may ask you to verify your identity through two-factor authentication. This could involve receiving a code on your mobile phone or email.

- Access Your Account: Once you've successfully logged in, you can access your TurboTax account dashboard. From here, you can start or continue your tax return, check the status of your refund, and access other features.

Features of TurboTax Login

Personalized Experience: TurboTax provides a personalized experience by remembering your details and preferences, making it easier to file your taxes each year.

Security: TurboTax uses advanced encryption and security measures to protect your personal and financial information.

Access to Tax Documents: Once logged in, you can access all your tax documents, including previous years' returns, W-2s, and 1099 forms.

Tax Advice: TurboTax offers access to tax experts who can provide advice and answer your questions as you navigate through your tax return.

Refund Tracking: You can track the status of your refund directly from your TurboTax account dashboard.

Mobile Access: TurboTax offers a mobile app that allows you to log in and manage your taxes on the go.

How to file a Tax on TurboTax

Filing taxes with TurboTax is easy and designed to be a user-friendly process, guiding you through each step of the way. Here's a general overview of how to file your taxes using TurboTax Login:

Step 1: Choose the Right TurboTax Version

Depending on your tax situation, select the TurboTax version that best suits your needs. TurboTax offers several versions, including Free Edition, Deluxe, Premier, and Self-Employed. Each version caters to different tax situations, from simple to more complex returns.

Step 2: Create or Sign In to Your Account

If you're a new user, create a TurboTax account. If you're a returning user, sign in to your existing account to access your previous tax returns and personal information.

Step 3: Gather Your Tax Documents

Before you start, gather all necessary tax documents, including W-2s, 1099s, investment income statements, and any deductions or credits you plan to claim.

Step 4: Start Your Tax Return

Click on the "Start a new return" button or continue where you left off from last year. TurboTax will guide you through a series of questions about your personal information, income, deductions, and credits.

Step 5: Enter Your Information

As you progress through the interview process, enter your information into the appropriate fields. TurboTax will use this information to calculate your tax return.

Step 6: Review Your Information

Once you've entered all your information, TurboTax will review your return for accuracy and completeness. It will also check for any tax-saving opportunities you may have missed.

Step 7: E-File or Print Your Return

After reviewing your return, you can choose to e-file your taxes directly through TurboTax or print your return and mail it to the IRS. E-filing is faster and more secure, and you'll receive your refund quicker if you're entitled to one.

Step 8: Track Your Refund

If you e-filed your return, you could track the status of your refund through the IRS "Where's My Refund?" tool or through your TurboTax account.

FAQ about TurboTax Login

What is TurboTax?

Ans: TurboTax is a tax preparation software developed by Intuit that helps individuals and businesses file their federal and state tax returns electronically. It offers a user-friendly interface and guides users through the tax filing process with a series of questions and prompts.

Is TurboTax free?

Ans: TurboTax offers a Free Edition for simple tax returns (Form 1040 with limited deductions). However, for more complex tax situations or additional features, users may need to upgrade to a paid version.

Can I import my tax documents into TurboTax?

Yes, TurboTax allows users to import their W-2s, 1099s, and other tax documents directly from many employers and financial institutions, saving time and reducing the risk of errors.

Can I file my state taxes with TurboTax?

Yes, TurboTax allows users to file both federal and state tax returns. However, there may be an additional fee for state e-filing, depending on the version of TurboTax used.

Can I access TurboTax on my mobile device?

Yes, TurboTax offers a mobile app that allows users to file their taxes, track their refund, and receive support from their smartphone or tablet.

Conclusion

Logging into TurboTax is a straightforward process that opens the door to a range of features designed to make tax filing easier and more efficient. By following the steps outlined above, you can access your TurboTax account Login and take advantage of the personalized tax assistance and security features offered by the platform.